What is Net Worth?

Net worth is the difference between a person’s assets and debt. An asset is a piece of property that belongs to a person or a firm and is considered valuable and available to pay obligations, commitments, or legacies.

- Building

- Real Estate

- Car

- Cash

- Stock

A sum of money owed or due is referred to as a debt.

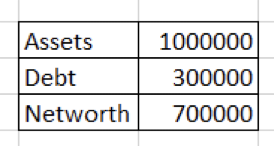

For example:

An individual owns assets worth rs.10,00,000. And owes sums of rs. 3,00,000. The net worth would be equal to Assets – Liabilities = 10,00,000 – 3,00,000 = Rs. 7,00,000

What is Liquid Net Worth?

A liquid asset is one that can readily be converted into cash in a short period of time with little or minimal loss of value. Liquid assets are often compared to cash since their value remains constant regardless of whether they are bought or sold. Businesses and purchasers frequently utilize this type of asset.

The different liquid assets that are more liquid, easily transferable are:

- Cash in Hand

- Cash in Bank

- Stocks

- Marketable Securities

The type of assets distinguishes net worth from liquid net worth. By deducting available liquid assets from debt, liquid net worth is computed.

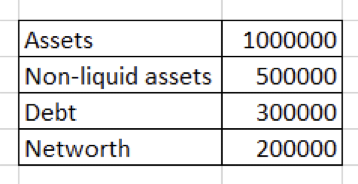

In our previous example, the individual had 10,00,000 in assets. If 5,00,000 were not liquid and were invested in non-liquid assets like real estate, the liquid net worth would be equal to

Liquid Assets – Liabilities:

What is the importance of Liquid Net Worth?

In general, net worth is a measure of a person’s present financial status. Liquid net worth is concerned with assets that can be converted into cash fast. As a result, liquid assets can be used to complement an emergency fund! Net worth is a fantastic strategy to accumulate money. If you need cash urgently, though, having a liquid net worth is critical. For instance, in the event of an emergency or a lucrative investment opportunity. Liquid net worth is important since it allows you to access funds quickly.

Liquid net worth is concerned with assets that can be converted into cash fast. As a result, liquid assets can be used to bolster an emergency reserve. If you need major repairs or medical bills that your insurance won’t cover, you’ll need an emergency fund.

If a person’s emergency money isn’t sufficient, liquid assets can come in handy!

Here are some ways to improve your liquid net worth!

1. Pay off liabilities:

Paying off short-term debts is an excellent approach to increase your liquid net worth. Once you’ve paid off the larger expenses that have been looming over your liquid net worth, you’ll be free.

2. Save more money/Reduce expenses

Your assets, and hence your liquid net worth, will improve as you save. And, in order to have more liquid assets on hand, you should begin to analyze and reevaluate your spending and expense patterns, and possibly reduce them.

3. Increase Income

Of course, earning more money is one approach to boost your liquid assets. This is why it’s always a good idea to keep an eye out for new ways to make money. You might also consider investing in a business that will provide you with a source of passive income.

gralion torile

March 4, 2022 at 8:00 pm

You can definitely see your expertise in the work you write. The world hopes for even more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.